Released: June 30, 2015

Consumer Action INSIDER - July 2015

Table of Contents

- What people are saying

- Did you know?

- Out and About: A debt-free college briefing on the Hill

- Introducing…our smaller but sophisticated downtown office!

- Hotline Chronicles: Unauthorized third-party phone charges are illegal

- Consumers have the right to control unwanted texts and mobile calls

- ‘Virtual’ intern explores evolving world of mobile payment apps

- EMERGE conference promotes financial inclusion for underserved

- Fifty shades of gray: The confusing world of Social Security and Medicare

- Coalition Efforts: From whistleblower rights to deadly window blinds

- CFPB Watch: 'Credit invisibles,' student debt stress and more

- Class Action Database: False advertising, stolen Sony account info

- About Consumer Action

What people are saying

Our clients are happy and thankful for the information/materials Consumer Action provides. Also, they save a lot of staff time. The materials are very easy to understand and have detailed information based on the topic. — Faith Espejo, Housing Opportunities Collaborative, San Diego, CA

Did you know?

Online retailers often fail to post warranty information for the items they sell. Last month, Edgar Dworsky of Consumer World spot-checked five items at each of 20 major online stores and found that many lacked warranty information despite Federal Trade Commission rules that require online sellers of items over $15 to post the actual warranty or tell customers how to obtain a free copy from the seller. Learn more at ConsumerWorld.org.

Out and About: A debt-free college briefing on the Hill

The debt-free college movement is more than a pipe dream. Presidential candidates Hillary Clinton, Martin O’Malley and Sen. Bernie Sanders have all endorsed this national goal during their current campaigns. Most recently, more than 70 members of Congress and nearly 400,000 Americans have backed debt-free college.

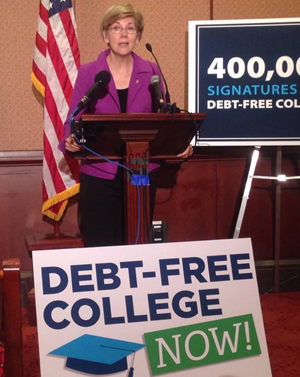

At a June 10 press event held by the Progressive Change Campaign Committee, influential supporters included Senators Elizabeth Warren (D-MA) and Chuck Schumer (D-NY).

Senator Elizabeth Warren speaks at a briefing last month about the Debt-Free College movement. (Lauren Hall photo)

During the conference, Senator Warren gave a touching speech about how, as the daughter of a janitor, she wouldn’t be where she is now, fighting on behalf of all consumers, if it weren’t for affordable college. She compared her experience decades ago to the very different one that students are confronted with now.

“A student at a public university today faces tuition prices that are more than 300 percent of what his or her parents faced 30 years ago,” Warren said.

Senator Schumer echoed Warren’s sentiment, declaring that “the cost of tuition is too damn high, to paraphrase that ‘rent is too damn high’ guy.”

Several students spoke at the press conference as well, including Maija Ross-Hall, a second year undergraduate who already owes $30k in student loan debt and anticipates owing over $90k upon graduation.

“The federal government aid has not been enough,” Ross-Hall said. “I’ve had to turn to family and friends. Still, every day the feeling of debt is like an anchor pulling me down.”

Justin Haber, legislative director at the United States Student Association, added that Ross-Hall had even gone so far as to start a GoFundMe crowdsourcing profile to raise money for her education.

“The average student graduates $30k in debt,” Haber said. “I just graduated and I’m $10k in debt. I’m actually considered one of the lucky ones!”

After members of Congress were presented with several boxes containing 40,000 signatures from concerned allies and students across the country, Representative Keith Ellison (D-MN) added that he hoped Congress would act quickly, since “people tend to see the light when they feel the heat, and they’re certainly feeling the heat now.”

Interestingly, a national poll showed that debt-free college is the number one issue that would have moved non-voting Democrats to vote in the 2014 polls.

Mark Huelsman, a senior policy analyst with the public policy group Demos, closed the conference by describing three tangible steps that his organization and others are encouraging Congress to take: increasing state financial aid for students, increasing overall federal student aid and addressing the underlying drivers that have caused college costs to skyrocket.

Introducing…our smaller but sophisticated downtown office!

For most of the past decade, Consumer Action’s main office was in the Embarcadero area of San Francisco. But due to rising rents, we decamped in June to a new office in San Francisco’s Civic Center area. Our new address is 1170 Market Street, Suite 500, San Francisco, CA 94102. Our phone numbers remain the same, including our hotline number, which is 415-777-9635. (See our website for more ways to contact us.)

The relocation process began in January, when we worked on the blueprints and permitting process for the renovation of the new space. Construction for an open floor plan with cubicles and a large mailroom began in April. Consumer Action received final approval for occupancy in late June, just two days before our move.

The new space at Civic Center is much smaller, but the staff is excited to embrace a more modern look and feel. The heavy old furniture that Consumer Action inherited from various corporations will not fit in our new office and will be donated to other charitable organizations.

While our staff, led by San Francisco Office Director Kathy Li, was organizing, consolidating and packing, we found many interesting historical Consumer Action materials. These included staff meeting minutes from the 1970s and records of past Consumer Action projects on food safety, healthy children and South of Market community development campaigns. Our archives contain newspaper profiles and clippings, pictures and more. We even unearthed award certificates signed by former San Francisco mayors George Moscone, who served from 1976 until his assassination in 1978, and Joseph Alioto, who held office from 1968 to 1976. We are now working to digitize these and other pieces of Consumer Action’s history.

Located in the fast developing mid-Market tech zone, our new space will be well-served by the next generation of high-speed networks, enabling us to better carry out our online consumer advocacy and educational efforts.

Hotline Chronicles: Unauthorized third-party phone charges are illegal

Carmen* from Tennessee called Consumer Action’s hotline in June to complain about charges on her T-Mobile cell phone for subscriptions she did not order. We advised her to contact the carrier, and if the charges are not reversed within one billing period, to follow up with a complaint to the Federal Communications Commission (FCC) and the Federal Trade Commission (FTC).

“Cramming” is the widely used term for unauthorized third-party charges to customers’ wireless and landline phone bills. Cramming is an illegal practice and has been under intense scrutiny by federal and state regulators. In recent years, the FCC and the FTC have brought enforcement proceedings against major carriers, including T-Mobile, for cramming.

In December, T-Mobile agreed to pay at least $90 million to settle an FTC lawsuit filed earlier in 2014. Under the settlement terms, T-Mobile agreed to refund its customers fully for the unwanted third-party charges it placed on their phone bills. The FTC suit charged that T-Mobile placed millions of dollars in unwanted third-party charges on mobile phone bills and received 35 to 40 percent of every charge. The charges were for services like horoscopes, love tips and celebrity gossip and were typically billed at $9.99 per month per service.

The FTC reported that T-Mobile’s phone bills made it “nearly impossible for consumers to find and understand third-party subscription charges.” In many instances, the third-party charges were “buried deep in phone bills that totaled more than 50 pages in length,” according to the agency.

The deadline for affected customers of T-Mobile (and AT&T, also the subject of an enforcement action and settlement) to request the resulting settlement refunds has unfortunately expired. However, if your telephone bill lists unknown or suspicious charges, call the telephone company responsible for your bill, explain that you did not authorize the purchases and ask to have the charges reversed. You also can call the company that charged you—its number should be on your bill—and ask for a refund.

If you cannot get unauthorized charges removed, file a complaint with:

- The FCC online or by phone at 888-225-5322.

- Your state public service commission for telephone services within your state. Click here to visit the National Association of Regulatory Utility Commissioners website, where you can find your state regulator’s contact information.

- The FTC online or by phone at 877-382-4357.

“Cases like Carmen’s show why it’s so important to pay attention to your bills,” said Linda Sherry of Consumer Action. “Start by checking the amount—if it’s higher than usual, dig deeper in the bill or call the carrier for an explanation.”

*Not this consumer’s real name.

Consumers have the right to control unwanted texts and mobile calls

Agreeing with consumer groups, the Federal Communications Commission (FCC) last month rejected a request to expand unwanted, automated cell phone calls and texts. The FCC issued clarifications to the Telephone Consumer Protection Act that would make it easier for consumers to say “no” to these “robocalls.”

Federal Communications Commission (FCC) Chairman Tom Wheeler recently wrote that, “Few things rankle consumers as much as unwanted calls and texts.” Representatives of national consumer groups, including Consumer Action, worked for several months to push back on a slew of industry petitions asking the FCC to allow companies to make repeated calls to cell phone numbers that formerly belonged to customers. Bankers, debt collectors, app developers, retailers and other companies filed the petitions.

Consumer advocates celebrated a victory on June 18 when the FCC issued a firm ruling advancing consumer protections against unwanted robocalls and text messages. The groups working to counter heavy anti-consumer lobbying from multiple sectors of industry include the National Consumer Law Center, Consumer Action, Consumers Union, the National Association of Consumer Advocates (NACA), U.S. PIRG and the Consumer Federation of America.

The FCC used its powers to issue a declaratory ruling rejecting most of the industry requests to undermine essential protections of the Telephone Consumer Protection Act (TCPA). The law requires specific permission from phone owners in order to call cell phone numbers. If a customer supplies his or her phone number to a company, this is typically considered permission to call the number. However, when that consumer changes his or her number and it is “reassigned,” permission to call the new owner expires. The industry unsuccessfully sought a pass from responsibility under the law when it called or texted these “reassigned” cell phone numbers using automated technology (“autodialers”). Unfortunately for the industry, FCC Chairman Wheeler ruled, “Consumers who inherit a phone number will not be subjected to a barrage of unwanted robocalls okayed by the previous owner of the number.”

The FCC provided limited exemption from the ruling to allow financial institutions to send, without consent, a very small number of robodialed text messages in the case of data breaches or suspected fraud on a credit card. It created a similar exception for certain messages from health care providers, who can call without the consent of the called party, as these are made at no cost to the called party.

Importantly, the Commission said that calls and texts could only be made with strict, immediately effective opt-out rights for consumers. Chairman Wheeler said the FCC wanted to “send one clear message: Consumers have the right to control the calls and texts they receive and [we’re enforcing] those rights to protect consumers against robocalls, spam texts and telemarketing.”

In its declaratory ruling, the FCC stated that robocall-blocking tools offered to consumers don’t violate anti-competition rules. It also clarified that the definition of “autodialers” in the TCPA covers any and all technology with the potential to dial random or sequential numbers.

Unwanted marketing calls are the top source of consumer complaints at the FCC. Last year it received more than 215,000 complaints related to unwanted and intrusive calls and texts.

Federal Trade Commission efforts. In related news, on June 10 the Federal Trade Commission (FTC) testified before the U.S. Senate Special Committee on Aging about its efforts to protect consumers from unwanted telemarketing calls and illegal robocalls. Lois Greisman, associate director of the FTC’s Division of Marketing Practices, said the Commission is using every tool at its disposal to fight illegal robocalls (some of which target seniors), including aggressive law enforcement, crowdsourcing technical solutions, and consumer and business outreach.

To date, more than 217 million phone numbers have been added to the National Do Not Call Registry run by the FTC. The FTC amended its Telemarketing Sales Rule in 2009, making the majority of robocalls illegal—regardless of whether a consumer participates in the Registry or not. Click here to read Greisman’s testimony (PDF).

‘Virtual’ intern explores evolving world of mobile payment apps

For the past five years, Consumer Action has welcomed student interns from the Columbia University Virtual Internship Program. The internships are “virtual” because the students, who attend school in New York City, complete their assignments without being in the same location as the sponsoring organization.

Consumer Action’s latest intern, Jingyan (Cindy) Xiao, completed her internship at the end of April after spending three months conducting research into the world of mobile payment apps.

From Apple Pay to Google Wallet, using a smartphone (instead of more traditional options like cash or a credit card) to pay at the checkout counter has become an increasingly available option. Not only are more retailers getting on board with the needed technology, more companies are focusing their efforts on mobile commerce and giving consumers greater options. While some consumers are already using their smartphones to pay, many others are hesitant to take the plunge.

Xiao’s research will help both early adopters and holdouts identify their ever-evolving choices, assess the advantages and disadvantages of each, and understand the consumer protections that do—or don’t—exist for mobile payments.

Xiao became a true, if temporary, consumer advocate during her three months on the project. “Over the course of my research, representatives were sometimes reluctant to discuss or clarify their policies on fraud,” reported Xiao, “which only emphasized, for me, how crucial it is for consumers to be informed about their rights when things don’t go as planned."

“Cindy did an outstanding job on this project,” said Ruth Susswein, who has managed Consumer Action’s participation in the virtual internship program since we welcomed our first intern in 2010. “She was tenacious about getting the information we needed—even if it required multiple attempts. The commitment and diligence she showed on this project will serve her well in her studies and her future career.”

As in past years, our intern’s research will be the basis for an upcoming issue of Consumer Action News, our quarterly consumer newspaper. Meanwhile, Xiao continues her studies in electrical engineering at Columbia.

EMERGE conference promotes financial inclusion for underserved

Last month more than 700 advocates, policymakers, bankers, financial technology innovators and other industry professionals attended the American Banker and Center for Financial Services Innovation (CFSI) EMERGE conference in Austin, TX. The conference brought stakeholders together to network, generate ideas and advance innovations in consumer financial health. The theme of this year's conference was “Insight, Innovation, Inclusion” for the financially underserved market.

Consumer Action's Audrey Perrott attended the event and reported back that "the EMERGE conference was an amazing experience from start to finish, with great panelists, timely presentations, countless networking opportunities and many interactive activities to keep attendees engaged.”

On day one, Perrott attended a pre-conference policy lunch. The session emphasized how institutions, innovators and regulators must work together to create quality products that improve consumer financial health. The discussion included how stakeholders can adopt better strategies to help financial institutions navigate the regulatory ecosystem.

During the luncheon, CFSI announced that it had conducted a financial health study, Understanding and Improving Consumer Financial Health in America. The study surveyed more than 7,000 households, revealing that 40 percent of Americans are struggling to make ends meet. The results emphasized that there are more factors involved in financial health than just the commonly researched areas of education, income and credit scores.

Perrott also attended a pre-conference session on underbanked and underserved populations. The session revealed that 47 percent of Americans have less than $1,000 saved, 58 percent have difficulty covering expenses and bills, 45 percent failed to save any earned income in 2012 and 61 percent of households lacked the recommended “rainy day fund” to cover three months of expenses in case of emergency.

Attendees went on to discuss how to develop innovative solutions to improve consumer financial health. Steven Wright of the San Francisco-based nonprofit EARN presented the agency's incentive savings program as a way to help consumers learn how to start a savings account. Alison Holt of Regions Bank discussed the Regions Now Card, a reloadable prepaid card that doesn’t allow overdrafts, so there are no related fees or interest charges for spending more than you have. Tony Chang of Visa Inc. outlined the company's prepaid card quality standards and its outstanding work in financial education.

“The EMERGE conference brought some of today’s greatest innovators together,” says Perrott. “I was honored to hear them share their ideas and outline all of the amazing investments they’ve made in helping consumers of all socioeconomic backgrounds navigate our increasingly complicated financial landscape.”

Fifty shades of gray: The confusing world of Social Security and Medicare

By Linda Williams

I am watching my hair turn 50 shades of gray as I struggle to map out a strategy to maximize my retirement benefits. It would be easier unraveling the human genome than trying to figure out the best strategy for taking my Social Security and Medicare benefits.

According to Forbes, the Social Security Handbook has over 2,728 separate rules as well as thousands of additional benefit explanations. Trying to figure out how to enroll, not to mention when to enroll, can be daunting. It’s the same situation with Medicare—the terminology is confusing, and the alphabet soup of options seems infinite. What’s more, even some of the so-called experts in the field contradict each other.

I can’t help but wonder how thousands of seniors like my mother, with their sometimes-limited educations, were able to figure out the intricacies of these benefits. At this point, I think I might be better off wearing a blindfold, spinning around and pointing to a random entry in a retirement handbook.

But this is serious. It’s the difference between spending the rest of my life in my daughter’s basement and lying on an exotic beach drinking piña coladas. So I’m doing my research. I’ve ordered books like AARP’s Social Security for Dummies, the New York Times bestseller Get What’s Yours: The Secrets to Maxing Out Your Social Security, and Kiplinger’s Retirement Planning 2015. According to the authors of Get What’s Yours, what you don’t know can seriously hurt you; wrong decisions about Social Security benefits cost some individual retirees tens of thousands in lost income every year. I want every dime I’m entitled to.

Mapping out a strategy. Kiplinger’s Retirement Planning tells readers that the first step is to decide how long you will live. As crazy as it sounds, you can find longevity calculators online. The websites Living to 100 and Blue Zones have them. (At BlueZones.com, click on “Vitality Compass” under the “Live Longer” menu at the bottom of the homepage.) The calculators give you a general estimate of how long you can expect to live. It appears that if you have a family history of longevity—especially on your mother’s side—you might consider delaying your Social Security benefits until full retirement age. (Your full retirement age will vary depending on the year you were born.) Since my mother just turned 93, I’ve decided to delay my retirement.

Another variable to consider before claiming benefits is marital status. Both AARP and Kiplinger point to an arsenal of strategies married couples can use to boost their payout. But since I am happily divorced—downright giddy, in fact—I skip most of the couples stuff and begin searching for strategies for a retiring bachelorette. Lo and behold, an appealing strategy discussed in the couples section is also listed as a strategy for singles.

Using the “File and Postpone” (also called “Claim and Suspend”) strategy, singles can apply for benefits when eligible (age 66 for those born between 1943 and 1954) and ask Social Security to suspend the benefits. Why? Social Security will not pay more than six months’ worth of benefits retroactively (and it won’t pay any retroactive benefits for the months before you’ve reached your full retirement age). If I file and suspend at age 66, I’ll be eligible to collect the benefits that accumulate after I filed.

The Kiplinger book gives an example that sold me on this strategy. A 66-year-old retiree was eligible to receive benefits of $2,500 per month. She decided to delay retirement until age 70, but at 66 she filed and suspended her benefits. Then, at age 68½ she became ill. Because she filed and suspended her benefits, she is eligible to receive 30 months of retroactive benefits totaling $75,000 for unexpected expenses or long-term care. Now, that’s a golden handshake!

Free sites offered by AARP, Financial Engines and T. Rowe Price could help you determine the best time to claim benefits. I used these free sites and all recommended that I take benefits at age 70 but use the “Claim and Suspend” strategy at age 66.

However, there is another variable that impacts my decision and it’s not discussed in any of the resources I found. Like millions of Americans, I am raising a grandchild and paying for her medical and dental care while she’s in college. I need to find out if employing this strategy would impact my ability to pay for her health care coverage through my employer. According to a March 2015 article published in USA Today, filing makes one eligible for Medicare Part A because enrollment is automatic for anyone older than 65 who applies for Social Security benefits. Consumers can’t opt out of Medicare Part A even if they want to. Automatic enrollment in Medicare Part A isn't necessarily a problem—at worse, it's duplicated coverage, but it doesn't have separate premiums or costs like Medicare Part B. However, it renders one ineligible to contribute to a health savings account. For individuals with a high-deductible health plan, “Claim and Suspend” makes them ineligible to contribute to the plan.

Medicare: Lost in translation. Most workers pay 1.45 percent of their earnings into the Medicare trust fund, and companies pay a matching 1.45 percent per employee. In 2013, the Affordable Care Act enacted an additional 9 percent Medicare tax on earnings of more than $200,000 for individuals and $250,000 for couples.

Having the right strategy for Medicare is as important as finding the right strategy for Social Security benefits, because taking a wrong step can cost you money. After signing up on a website to receive information about Medicare, my mailbox is running over with advertisements from HMOs, each promising that they can make it simple to apply. HMOs offer “Medicare Advantage” managed care plans that differ from “original Medicare.” However, each Medicare Advantage plan can charge different out-of-pocket costs and have different rules for how you get services (like whether you need a referral to see a specialist or if you have to go to only doctors, facilities or suppliers that belong to the plan for non-emergency or non-urgent care). These rules can change each year.

A few of the Medicare Advantage HMOs that sent me mail also offered in-person classes, while others held webinars. But as I combed through the mounds of material, all I found were gigantic contradictions and a dizzying array of choices. So I decided to sit in on a three-hour class offered by my current health care provider, Kaiser Permanente. As soon as the commissioned facilitator leaned that I was not retired, and that retirement was not in my near future, she began taking questions from the more immediately qualified participants. As I was leaving the seminar, she did tell me that my first step towards applying for Medicare should be to ask my employer two questions: (1) When I turn 65, does company policy dictate that I take Medicare benefits? and (2) Is there any provision in the company’s plan that requires me to assign my Medicare benefits to the company? If the answer to either or both is yes, then my employer’s policy dictates when I should apply for Medicare.

You can sign up for Medicare beginning three months before you turn 65, and coverage can start as soon as the first day of your birth month. The initial enrollment period extends three months after your 65th birthday. If you miss signing up in these few months before and after your 65th birthday, you still can enroll during Medicare’s open enrollment period (Jan. 1 to March 31) each year, but your premiums will be higher. In this case, your coverage would begin on July 1 of that year.

But as complicated as it seems, AARP says that there’s one simple choice: Choose the original Medicare plan, run by the federal government and consisting of Medicare Part A and Part B, or choose a Medicare Advantage plan (Part C), offered by private insurers and regulated by Medicare.

When you apply for Medicare, you are automatically enrolled in the Part A plan. Part A is your hospital insurance plan. It covers nursing care and hospital stays, but not doctors’ fees. You will not pay a monthly premium for Medicare Part A, thanks in part to the payroll taxes you paid while employed. However, you will be required to pay a yearly deductible before Medicare will cover any hospitalization costs. For 2015, the Part A deductible is about $1,260.

Medicare Part B pays for a large portion of your doctor visits, some home health care, medical equipment, outpatient procedures, rehabilitation therapy, ambulance services, blood work, lab tests, X-rays and mental health services. Part B is optional, and you might want to opt out of Part B if you stillhave health insurance through an employer, union or your spouse. However, monthly Part B premiums increase by 10 percent for each 12-month period you were eligible for Medicare but didn't sign up.

If you or your spouse is employed and covered by a group health plan at work, you must sign up within eight months of leaving the job or losing coverage to avoid the higher premiums. It’s important to plan in advance to sign up during that time, because if you choose to sign up later, it will cost you more.

According to Medicare.gov, consumers pay a premium each month for Medicare Part B. Most people will pay the standard premium amount. However, if your modified adjusted gross income as reported on your federal tax return from two years ago is more than a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA)—an extra charge added to your premium.

The out-of-pocket costs for original Medicare Part B can be surprisingly hefty. That’s why most people with original Medicare decide to buy a Medigap or other supplemental policy. Shop carefully, because the cost of these additional policies can run you several hundred dollars extra per month, but can save you thousands in the long run.

Finally, if you’re eyeing retirement in an exotic clime (I sure am!), Medicare generally won’t cover your health care costs while you’re traveling abroad. While you can keep your Medicare in force by paying the premiums, you’ll probably have to shoulder the costs for health care outside the U.S.

Coalition Efforts: From whistleblower rights to deadly window blinds

Consumer Action and its allies have been involved in a number of new issues:

Keep the consumer watchdog independent of partisan politics. The House Appropriations Committee is reviewing a provision in the Financial Services and General Government Appropriations bill that would bring funding for the only dedicated consumer watchdog agency, the Consumer Financial Protection Bureau (CFPB), under the annual congressional appropriations process. The Bureau currently receives automatic funding from the Federal Reserve. If the CFPB is funded through appropriations, partisan politics could restrict its regulatory authority and force it to submit to time-consuming and unnecessary reporting requirements. Learn more and read the letter.

Protect borrowers, not banks, from risky loans. Coalition advocates wrote to Congress asking them to oppose HR 1210. The bill would change the new qualified mortgage rules in the Dodd-Frank Wall Street Reform and Consumer Protection Act’s “ability-to-repay” requirement. HR 1210 contains a questionable exemption that would put all the risk of bad loans on the borrower and protect lenders from legal responsibility for failing to correctly underwrite mortgage loans. Learn more and read the letter.

Bringing Lifeline into the digital age. The federal low-income assistance program for affordable communications services, Lifeline, is on the verge of a “reboot” to provide eligible low-income households with discounted high-speed broadband Internet service. Modernizing the program is essential for thousands of low-income households that may be left behind as more and more aspects of our life go online, from job applications to bill paying. Learn more and read the letter.

Defenseless whistleblowers forced to risk it all. Consumer Action joined its allies in asking Congress to move quickly to restore whistleblower protections for government contractors who work in the intelligence community. In addition to facing the threat of criminal prosecution, intelligence contractors currently lack statutory protection against employer retribution, including terminations, demotions and blacklisting, when they expose government misconduct in an attempt to further the public interest. Learn more and read the letter.

U.S. Department of Education must do more to prevent widespread fraud. In light of the recent bankruptcy and subsequent campus shutdowns of disgraced for-profit Corinthian Colleges, coalition advocates are urging the Education Department to develop a proactive strategy that would prevent for-profit schools under investigation for predatory practices from receiving federal aid and further defrauding students. Learn more and read the letter.

Protecting children from strangulation. Consumer advocates argue that it’s time for the Consumer Product Safety Commission to regulate window blind cords. Since 1996, there have been 285 identified incidents of children being strangled by these cords. More than half of those incidents have resulted in death. Advocates say the window covering industry’s current system of self-regulation is deeply inadequate, and while the standard has been revised multiple times over the past two decades, it’s still ineffective. Learn more and read the letter.

CFPB Watch: 'Credit invisibles,' student debt stress and more

The Consumer Financial Protection Bureau (CFPB) will require refunds to Ally Bank car loan customers who were the victims of discriminatory pricing. It also released a study that attempts to discern why certain people don’t have a documented credit history, and is collecting stories from members of the public who are “stressed” by student loans.

Discriminatory pricing refunds. The CFPB and the Department of Justice (DOJ) recently ordered Ally Financial (and Ally Bank) to refund minority consumers $80 million for using discriminatory pricing in its auto loans. The agencies found that Ally was allowing car dealers to “mark up” interest rates, charging African-American, Hispanic, Asian and Pacific Islander customers more than anyone else for no reason.

Minority borrowers who received an Ally auto loan between April 2011 and Dec. 2013 should receive a refund settlement package in the coming weeks with forms to be filled out and submitted no later than Oct. 24, 2015.

Ally customers who believe they are eligible for a refund but do not receive a settlement package by July 15 can contact the Ally settlement administrator, Heffler Claims Group, at 844-271-4780 or via the settlement website.

The CFPB warns consumers to watch out for scammers who want to charge you a fee or gather your personal information in order to receive your refund. There is no fee to file a claim or collect the Ally refund. Amounts returned will depend on how many borrowers apply.

Credit invisibles. As many as 26 million U.S. consumers, or more than one in 10 American adults, are considered “credit invisibles,” which means that they do not have a credit history with one of the three national credit bureaus (Experian, Equifax and TransUnion). Those who are credit invisible have far more trouble getting access to car loans, student loans, credit, insurance, jobs and more.

The CFPB’s Office of Research also found that another 19 million consumers (8.3 percent of Americans) have credit records but are considered “unscorable” due to having too few payment records or too old a credit history to create a credit score. The Bureau’s recent report also found that about 30 percent of people from low-income neighborhoods were considered credit invisible, while about 15 percent of Black and Hispanic consumers have no credit history (compared to 9 percent of White or Asian consumers).

Click here for more information on the CFPB’s research.

Tell the government about your student debt stress. After being bombarded with complaints from student borrowers, the CFPB has opened an investigation into the student loan servicing industry. Student loan servicers are the companies that send your billing statements.

If you or someone you know are struggling with student loans and have encountered problems with a loan servicer, please share your story with the CFPB. The federal agency is seeking feedback on servicer practices that make it more difficult to pay off your debt. Contact the CFPB if you’ve hit any of these roadblocks while trying to repay your student loans: surprise fees, lost paperwork, bad information or poor communication, payment processing problems or servicer transfer errors.

The deadline to submit comments is July 13. The agency asks that you do not include sensitive information like account numbers and Social Security numbers in your comments. Be aware that when you submit comments to federal agencies, your full name may appear online.

Class Action Database: False advertising, stolen Sony account info

Class action settlements involving Michaels (custom framing) and Bank of America/Countrywide (failure to release mortgage liens) were among the new cases added to Consumer Action’s Class Action Database during the last month.

Bank of America and Countrywide (Georgia property lien releases). Consumers who owned residential property in Georgia with a mortgage serviced by Bank of America or Countrywide between Feb. 12, 2007 and April 1, 2015 and who paid the loan in full but did not receive documentation may be eligible for up to $500. (Bank of America acquired Countrywide, a mortgage lender.) The company reached a settlement over allegations that it failed to cancel the lien within the time required by Georgia law. The claims deadline is Aug. 24.

Michaels (custom framing). Consumers who purchased custom framing products or services at Michaels stores in Ohio from Jan. 1, 2009 to Oct. 7, 2011 may be eligible for a $32.50 Michaels certificate. The company reached a settlement over allegations of falsely advertising its custom framing products and services as being on sale when in fact they were not. The claims deadline is July 13.

Sony gaming networks. Plaintiffs filed a class action against Sony claiming the company did not adequately protect the Sony PlayStation Network, Qriocity and Sony Online Entertainment gaming networks after a 2011 hacking attack. Plaintiffs—gamers who suffered fraud and identity theft—claimed they were injured because Sony failed to protect itself against criminal intrusion. Sony denied all allegations but agreed to a settlement to avoid the burden, expense and risk of continuing the lawsuit. Class members receive defined benefits (see below) as well as potential reimbursements for certain out-of-pocket expenses from any identity theft proven to have resulted from the intrusions.

The class members are defined as persons in the United States who had a PlayStation Network, Qriocity or Sony Online Entertainment gaming network account before May 15, 2011. The following accountholders are affected:

- PlayStation Network accountholders who did not sign in between May 15, 2011 and June 13, 2014 and had a balance of $2 or more are eligible to receive payment equal to the paid virtual currency in their PlayStation Network wallet, or to resume use of the PlayStation Network account to use the pay-out;

- Active PlayStation Network accountholders are eligible for one free game, three free PlayStation3 themes or a free three-month subscription for PlayStation Plus;

- Qriocity accountholders without a PlayStation Network account are eligible for a $9.99 cash payment;

- Sony Online Entertainment accountholders who did not sign in between May 15, 2011 and June 13, 2014 and had a balance of $2 or more are eligible to receive payment equal to the paid virtual currency in their Sony Online Entertainment wallet, or to resume use of the account to use the balance and receive a pay-out of $4.50 in “station cash”;

- Active Sony Online Entertainment accountholders are eligible to receive a $4.50 deposit of “station cash.”

Class members may be eligible for an up to $2,500 reimbursement of out-of-pocket charges due to actual identity theft. The claims deadline is Sept. 4.

About Consumer Action

Consumer Action is a non-profit 501(c)(3) organization that has championed the rights of underrepresented consumers nationwide since 1971. Throughout its history, the organization has dedicated its resources to promoting financial and consumer literacy and advocating for consumer rights in both the media and before lawmakers to promote economic justice for all. With the resources and infrastructure to reach millions of consumers, Consumer Action is one of the most recognized, effective and trusted consumer organizations in the nation.

Consumer education. To empower consumers to assert their rights in the marketplace, Consumer Action provides a range of educational resources. The organization’s extensive library of free publications offers in-depth information on many topics related to personal money management, housing, insurance and privacy, while its hotline provides non-legal advice and referrals. At Consumer-Action.org, visitors have instant access to important consumer news, downloadable materials, an online “help desk,” the Take Action advocacy database and nine topic-specific subsites. Consumer Action also publishes unbiased surveys of financial and consumer services that expose excessive prices and anti-consumer practices to help consumers make informed buying choices and elicit change from big business.

Community outreach. With a special focus on serving low- and moderate-income and limited-English-speaking consumers, Consumer Action maintains strong ties to a national network of nearly 7,500 community-based organizations. Outreach services include training and free mailings of financial and consumer education materials in many languages, including English, Spanish, Chinese, Korean and Vietnamese. Consumer Action’s network is the largest and most diverse of its kind.

Advocacy. Consumer Action is deeply committed to ensuring that underrepresented consumers are represented in the national media and in front of lawmakers. The organization promotes pro-consumer policy, regulation and legislation by taking positions on dozens of bills at the state and national levels and submitting comments and testimony on a host of consumer protection issues. Additionally, its diverse staff provides the media with expert commentary on key consumer issues supported by solid data and victim testimony.

Quick Menu

Support Consumer Action

Join Our Email List

Housing Menu

Help Desk

- Help Desk

- Submit Your Complaints

- Frequently Asked Questions

- Links to Consumer Resources

- Consumer Services Guide (CSG)

- Alerts