How one housing agency uses our free resources to help its clients

Habitat for Humanity of the Mississippi Gulf Coast (HFHMGC), in Gulfport, Mississippi, builds and sells affordable housing, rehabilitates existing housing and provides free one-on-one financial coaching and group education.

Before 2007, Harrison County Habitat for Humanity and Habitat for Humanity of Jackson County were separate affiliates, building no more than three houses each per year. In January 2007, they merged and created Habitat for Humanity of the Mississippi Gulf Coast. Since then, the group has incorporated another nearby county in southern Mississippi (Stone County) and has directly and indirectly constructed or repaired more than 1,500 houses throughout the three counties.

In July, the agency contacted Consumer Action to thank us for the information we provided to staff who attended our When a collector calls: An insider’s guide to responding to debt collectors webinar and to let us know how its staff has used our free educational publications in every class that they teach. They also display a publication kiosk in their lobby, where consumers can pickup whichever publications interest them.

Client services program specialist Larisa Milner wrote: “Thank you for this great source of information. I am using Consumer Action publications and education materials every day. Everything is very helpful!”

We were pleased to hear the group has used a wide range of Consumer Action publications since 2008. We interviewed Milner to find out more about how she and other staff currently are benefitting from our materials. The organization’s director of client services, Tomesha Thompson, agreed to tell us more.

First, how would you describe your agency’s mission?

With the right support and resources, we believe that people can make change in their own lives, and together those individual changes can make change in a community. We believe that the experience of making change in one’s own life is a valuable experience regardless of the result. It is our mission to offer individuals in our service area the opportunity to transform and feel empowered in their day-to-day living through housing and financial opportunities.

Who is your target audience?

We serve low-to-moderate-income families.

Are there income and geographic limits to whom you serve?

There are limits for homeownership and rehab programs. We have no income or geographic limits for education and coaching.

Has your staff used Consumer Action publications in your education program?

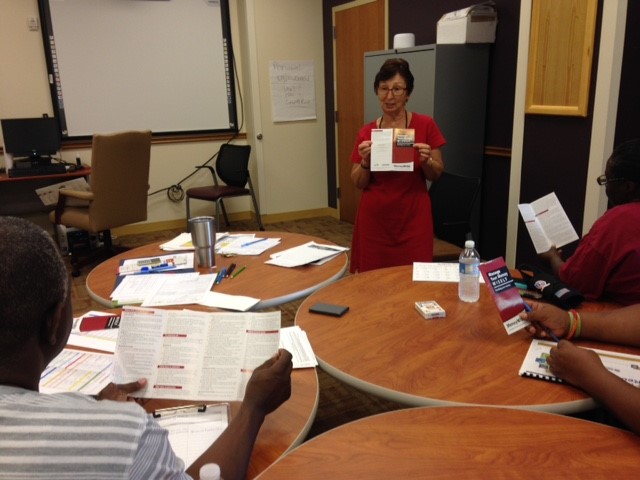

Yes. There is a Consumer Action publication for every class we offer. We always offer the corresponding publications during and after class. We also have them readily available in our lobby area for the general public.

Has your staff attended Consumer Action trainings?

Ms. Milner has participated in six MoneyWi$e webinars and one When a Collector Calls: An Insider’s Guide to Responding to Debt Collection webinar.

Do you download our free materials or use our printed publications (or both)?

We use the printed publications, including MoneyWi$e, Checking and Savings Accounts, The Right Overdraft Protection Plan, The Fair Debt Collection Practices Act, Debtors’ Rights, Economic Survival Guide for Servicemembers and Veterans, Money Management 1-2-3, and more.

What best practices can you share regarding using Consumer Action materials?

Provide the publications to supplement and reinforce the information you are offering. The materials are easy to digest for varying education levels.

What other financial education materials do you use in your education and coaching programs?

We also use the FDIC’s Money Smart, and curriculums we have developed in-house.

Is there anything else that you would like to share about how partnering with Consumer Action has enhanced your financial education and coaching programs?

We appreciate the educational material provided by Consumer Action at no charge to our agency. It is just one more thing we can provide to our clients to help them move toward financial capability.

To learn more about Habitat for Humanity of the Mississippi Gulf Coast, visit its website.

Quick Menu

Support Consumer Action

Join Our Email List

Housing Menu

Help Desk

- Help Desk

- Submit Your Complaints

- Frequently Asked Questions

- Links to Consumer Resources

- Consumer Services Guide (CSG)

- Alerts